Unparalleled Performance &

Connectivity

Streamlined Operations

Flexible Connectivity

Low Latency Trading

High-Level Security & Integrity

Added Value Solutions

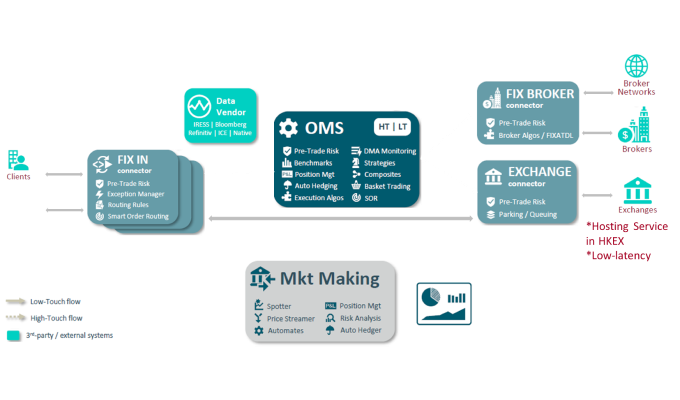

Order Management System

Case Study

Collaboration Flows

01

02

03

04

05

06

STEP 0

Establish our collaboration intent

STEP 1

Collect your information

STEP 2

Tailor customized solutions

STEP 3

Solution finalization

STEP 4

Project implementation

STEP 5

Platform usage support

.png)